Estimated reading time: 2 minutes

Skill Level: Beginner

TaxJar is an absolute time-saver when it comes to calculating and managing US tax rates for your e-commerce website. Keeping your state settings up-to-date is a crucial but simple task. Here’s how!

STEP ONE: Edit Your Settings in TaxJar

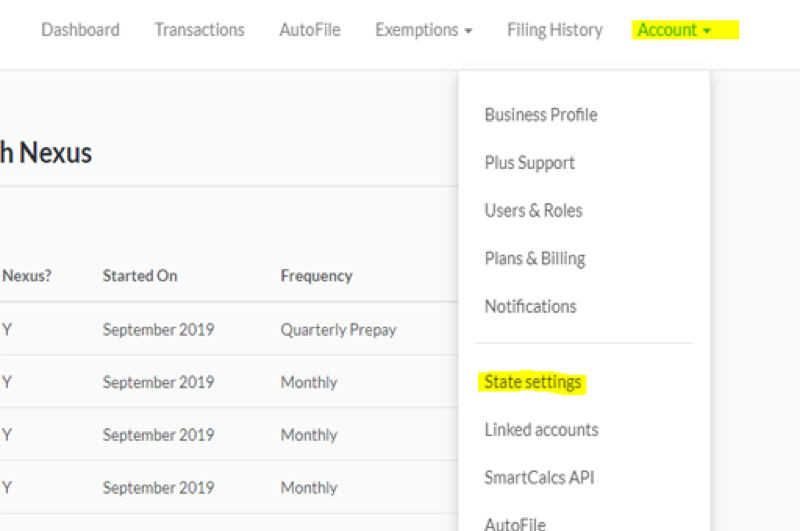

Log into your TaxJar account at www.taxjar.com and make any necessary changes there by clicking on Account, then State Settings.

Make your edits then close out of TaxJar.

STEP TWO: Update Your TaxJar Settings In Miva

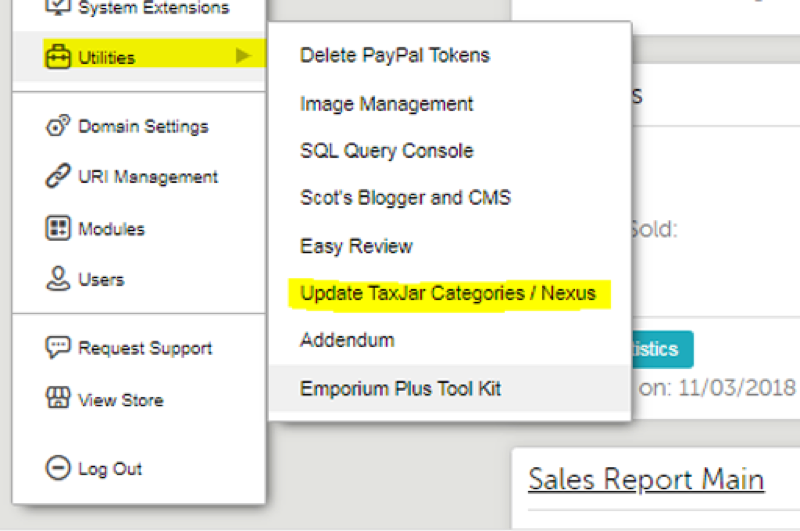

Log into your Miva admin account. From the menu in the top left corner, hover over Utilities, then select Update TaxJar Categories/Nexus.

Once on that screen, click on the gray Update Nexus Regions button.

STEP THREE: Confirm Your State Settings

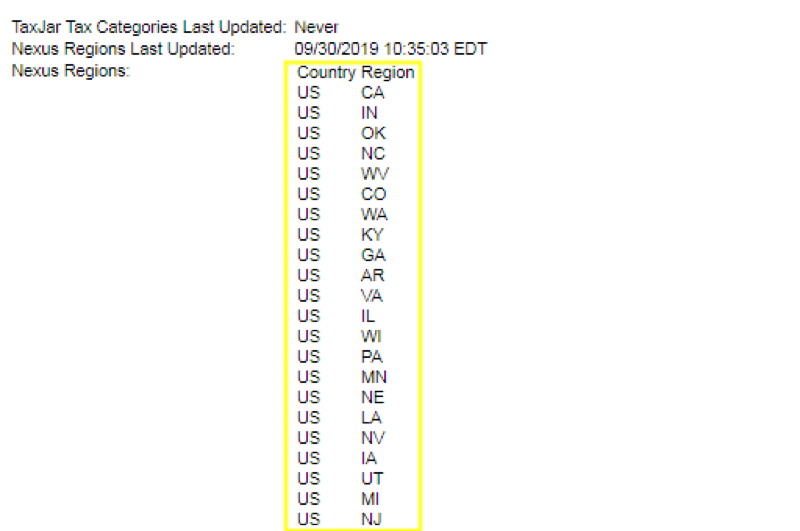

Once you’ve made your changes in Miva, you can confirm that you’ve got the correct states. Click on the menu button once again, and select Store Settings. The bottom of the Store Settings page, under the TaxJar section, will show you which states Miva is collecting for.

As simple as a couple of clicks, you can have your state settings updated in Miva. Feel free to contact us if you have any questions or need help further configuring your TaxJar setting in Miva.